It is a well-known fact that wireless connectivity is a key component of the Internet of Things (IoT). Embedded systems in various disciplines, such as transportation, medical, smart grid, industrial, home and automation, are more often than not integrated with wireless connectivity called machine-to-machine (M2M) communication. These systems need not necessarily be M2M-capable, but these do include an assortment of sensors and other devices.

M2M-enabled devices and sensors make use of different kind of wireless data-transfer methods and protocols, such as ZigBee, 802.11, Bluetooth 3.0 and 4.0, and wireless local area network (WLAN) or Wi-Fi, among others. Although each communication method is designed for specific ranges of usage and applications, these all play a role in connecting devices to the IoT.

Data transfer using ZigBee wireless technology

Data transfer using ZigBee wireless technology

Establishing M2M communication in a network comprising a variety of servers, sensors, equipment, controllers and storage devices is a complex process. Let us take a look at how today’s M2M chipsets and modules are addressing the challenges involved and supporting various protocols on a single chipset or module, making it a perfect choice for M2M networks of the future.

How to select the right chipset/module

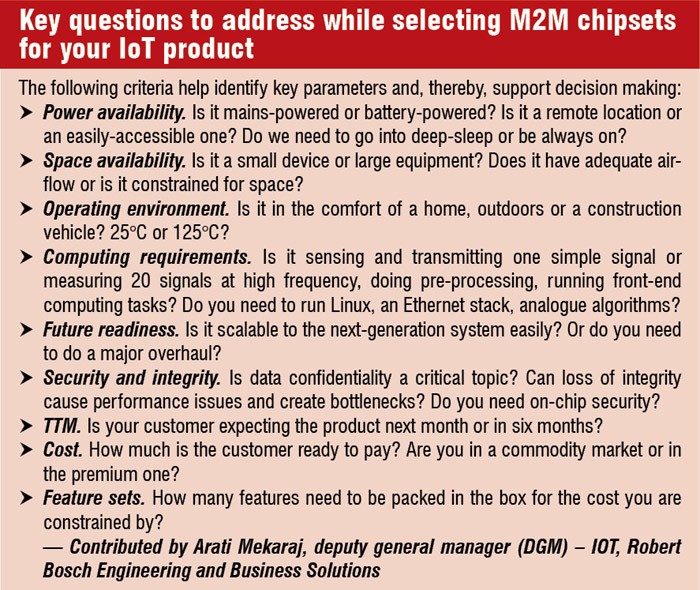

The usual selection of components goes through a lot of filters, like cost, availability, forward and backward compatibility, and others. Some other criteria include power-consumption and ease-of-integration based on the size of chipset and number of external components required. All chipset decisions must be based on the end use case being targeted, believes Arati Mekaraj, deputy general manager (DGM)–IOT, Robert Bosch Engineering and Business Solutions. She says, “The solution must never begin from the chipset but must culminate in the chipset. The problem must drive the solution and not the other way around.”

The designer should also look at characteristics and requirements of the end product, notes Narasimhan Venkatesh, senior vice president, Advanced Technologies. Some factors with respect to end products that need to be considered are number of sensors needed, amount of processing required, battery-life expectation, wireless or wired protocols to be supported, allowable size, regulatory requirements based on where it will be sold, etc. With these known, chipsets and modules can be chosen.

Another deciding factor is time-to-market (TTM), indicates Anand T., director, Knewron Technologies, as any wireless chipset or module would need to go through tedious certification processes, such as FCC and CE. He says, “It is expected that usually modules would be available pre-certified from manufacturers. This means a lot of cost is already taken care of, in addition to the time involved, and that is going to make or break situation for many.”

Three difficulties to overcome for M2M-IoT products

At a very high level for all M2M products, it essentially boils down to three factors while selecting the right chipset or module for your design, according to Anshuman Singh, founder, ReTiSense. He says, “One, what kind of data you are sensing and how to retrieve that? Two, how are you establishing communication between devices at short distances? Three, how are you establishing communication between devices at long distances?”

Data sensing. Talking about the kind of data collected and the process, Singh notes, “One of the big challenges in M2M is not to verify whether the data can be sensed or not. If you look into any air-conditioning machine, generator, transformer or any industrial-grade machine, data is always present. The actual difficulty is in identifying the kind of data generated, collating it and making sense out of it.”

Citing an example, he says, “The kind of data a Schneider generator or transformer generates and transmits would be very different from a General Electric (GE) machine. It would be very difficult, especially for a start-up, to figure out all those differences, get access to the kind of data they report and build some intelligence out of it.”

Short-distance communication. Suppose there is a large installation of a heating, ventilation and air-conditioning (HVAC) system that comprises many machines that work together. The ways in which small and medium sized businesses, such as hospitals or apartments, build such a system is by getting various machines from different vendors at the best possible prices and having somebody to hook them up. Assuming that these machines are placed in close range, the question that arises is what kind of protocol is to be used for this short-distance communication to be possible, where the data is collated at a local hub or gateway.

There are many protocols and each vendor favours a different kind of protocol for its machines. Singh says, “All big players are coming up with their own standards. The most pervasive are ZigBee, Bluetooth Low-Energy (BLE) and Wi-Fi. Google is coming up with 6LoWPAN. There are many variations as well of these local transmission protocols.” He adds, “Therefore to build a system with wide adaptability, it needs to support all protocols, or the designer needs to segment devices and companies based on the kind of standards their machines support, as each protocol requires specific investment and knowledge-base that the designer needs.”

Long-distance communication. Long-distance communication is not just about getting data to the server, it is about the whole stack—how to get the data to the server, how the server interprets and makes sense of it, informs Singh. Again, there are a lot of protocols, and each of these has its individual stack. Let us take a few examples.

Singh says, “The most common and easy-to-understand is the Transmission Control Protocol/Internet Protocol (TCP/IP) based protocol. You could send the data out from your local gateway to a server via IP version 6 (IPv6). One big problem with TCP/IP is that it is very expensive with regards to power, and the overhead is also very high, especially if you have hundreds or thousands of devices sending data.”

IBM, a few years ago, came out with a protocol named Message Queuing Telemetry Transport (MQTT), which, Singh notes, is a short messaging protocol, where the device or gateway would broadcast the message over a hub. Individual servers or applications that need access to the data can subscribe to it. He adds, “There are many other proprietary protocols that companies like Schneider or GE have built on data-collation. So, there is a big problem of fragmentation and how to build the application in a way that you can deploy multiple vendor machines.”

You can add LTE connectivity to your designs

To make M2M- and IoT-enabled devices, there is a need for a simple Long-Term Evolution (LTE) platform, as industry experts believe LTE-enabled IoT is an upcoming trend. As LTE gains momentum around the world, the market for single-mode LTE module solution provides a huge opportunity, as modules could be a worthy option for many IoT device makers.

Electronics manufacturing companies have started incorporating LTE chipsets to bring to market a module optimised for the design of devices for the IoT. Such modules aim to target the needs of M2M and IoT device makers for a straightforward, all-in-one, single-mode LTE chip solution for the design of reasonably-priced devices for numerous IoT applications. It is slowly growing as more and more economies are changing to LTE infrastructure these days. Faster data rates and high bandwidth demands are also fuelling these requirements.

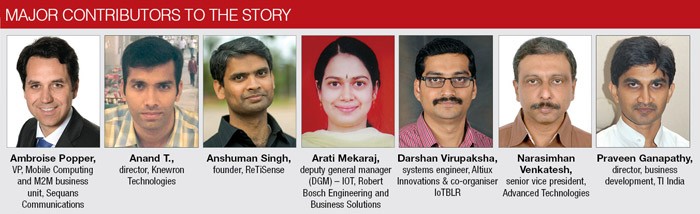

Ambroise Popper, VP, Mobile Computing and M2M business unit, Sequans Communications, says, “Although it only represents a small portion of the overall M2M market, demand for LTE-enabled M2M is growing fast today. By the year 2017, one market analyst predicts, 70 per cent of M2M modules will be LTE.” He adds, “Driving M2M applications for LTE are metering, home-automation, automotive accessories and wearables.”

Although carriers and LTE module makers are focused on the M2M market for looking beyond people-centric mobile communications, the cost of deployment and operation is a deterrent, feels Venkatesh. He says, “Greater demand is for modules that offer wireless communication in unlicensed spectrum—protocols applicable being Wi-Fi, Bluetooth 4.0, ZigNee, ANT+, to name a few.” He adds, “It remains to be seen what the uptake on LTE-U (LTE in the unlicensed 5GHz band) would be.”

Talking about implementation of LTE for IoT solutions in the current Indian scenario, Darshan Virupaksha, systems engineer, Altiux Innovations & co-organiser IoTBLR, feels, it is a milestone set too far to achieve. He says, “Although the all-IP architecture of LTE is a perfect fit for the IoT, the ecosystem is not ready yet. The upcoming government spectrum auctions might change the scenario.” He adds, “A couple of module vendors have 4G modems in the market, and one can say that, the demand has not attained critical mass. Telematics solutions and large-scale implementations like smart cities could be one of the first adopters of 4G in India.”

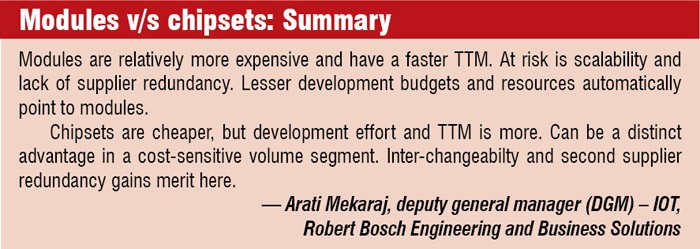

M2M chipset or an M2M module–how to decide

For low volumes, like less than 50,000 units, modules would be best-suited, feels Virupaksha. On the other hand, he says, “Chipsets come with low per-unit cost, and there would be high certification costs included. It would be viable to go for chipsets only for volumes around one million or so.”

Certification is a key factor to be considered by designers for today’s chipsets and modules. M2M modules come pre-certified. Praveen Ganapathy, director, business development, TI India says, “It could take four to six months for a designer to get his design certified if he starts from scratch. Having a certified module gives a greater edge, especially for a start-up looking to do a quick proof-of-concept, evaluate and get it to the market quickly.” He adds, “It really is a balance between volume, TTM and cost.”

Some other benefits associated with using modules are shorter development period, higher per-unit costs, ruggedness and reliability. A bare minimum of RF expertise is required to work with modules. Popper says, “A module requires much less research and development expertise from a developer when compared to a chipset.” He adds, “For carriers with hard certification programs, a pre-certified module makes more sense.”

What is the biggest reason people would go for modules, questions Singh. He explains that, in the software world, it is very common to use a very high-optimised module and library if something is going to be repeated over and over again. This is transitioning to the hardware world as well. Singh adds, “A module that has been built for BLE, ZigBee or Wi-Fi is packed immensely dense, such that the size and power consumption goes down significantly. If I am building my solution from scratch, I would probably not be able to get that level of integration and power-consumption. So, that is why I prefer using modules.”

Time-to-market is a very important consideration to make, informs Ganapathy. He says, “If you have a very short timeline, it is better to go for a module because you have something almost there as a product.”

Another deciding factor for modules versus chipsets depends on the kind of target volume a designer has in mind. Singh says, “Let us suppose you have a target volume in 1000s. The expenses to be incurred would include cost of designing a radio circuitry and certification costs.”

There are certain frequency bands restricted for transmission by government, which are different for different countries. Ensuring the fact that it is working perfectly across various geographies, and making sure the device’s harmonics do not interfere with restricted frequency bands, adds a lot of upfront cost to it, notes Singh. He adds, “It does not make sense to bear that cost for a volume in 1000s. But, if you are going to do a product to be manufactured in millions, then it makes sense to actually design everything from scratch.”

For developers, it is going to be ease-of-interfacing and design-integration to the main board. Whether chipset provides that ease or module does, that would eventually be the deciding factor. However, Anand says, “It is expected that modules would be easier to interface and integrate, rather than chipsets, and they would also involve additional design care and complexities.” He adds, “An integrated chipset will be a lower-cost solution, but with design and certification challenges. I think, modules would win over chipsets in the long run.”

Modules will cost lesser in future

The better the integration, the more cost-effective the designer is going to be at a system level, notes Ganapathy. He says, “The chipset cost might actually increase as more and more features are integrated, because earlier you might have had to use a separate microcontroller and RF device. Now, you have one chip performing both functions, including integration of front-end modules.” He adds, “So, as you integrate more, the system-on-chip may actually go up. But, when you look at the overall system cost, the price comes down. As volumes pick up, we could expect the prices of modules and chipsets to go down.”

“Prices are decreasing as the volumes are increasing,” comments Anand on the pricing of modules. However, until recently, prices seem to have stagnated and, perhaps, are waiting to change in some direction depending upon the market demand. He adds, “They are set to go down in the near future.” However, there is one factor that may increase the price of modules and chipsets—functionalities and features. Anand adds, “If manufacturers could add more of those, they would be demanding premium and, hence, a bit higher price than basic counterparts.”