IoT Analytics, this month launched the State of IoT – Summer 2021 and the updated Cellular IoT & Low-Power Wide-Area (LPWA) Market Tracker (Q3 2021), finding that the number of connected IoT devices is growing 9% globally.

Market Update

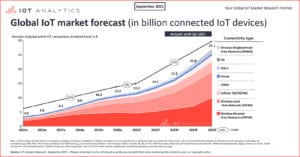

Despite the chip shortage and COVID-19’s extended impact on the supply chain, the market for the Internet of Things continues to grow. In 2021, IoT Analytics expects the global number of connected IoT devices to grow 9%, to 12.3 billion active endpoints. By 2025, there will likely be more than 27 billion IoT connections.

This is one of many findings in IoT Analytics’ latest reports: State of IoT—Summer 2021 and the updated Cellular IoT & Low-Power Wide-Area (LPWA) Market Tracker (Q3 2021).

The 2020 actuals for the number of connected IoT devices came in slightly lower than the mid-year 2020 forecast (11.7 billion connected IoT devices forecasted for 2020 vs. actual of 11.3 billion).

The forecast for the total number of connected IoT devices in 2025 has also been lowered to 27.1 billion (compared to 30.9 billion forecasted in 2020). Two critical factors are leading to the dent in the growth curve:

The COVID-19 pandemic: COVID-19 has impacted both demand and supply. Supply was reduced, as production was halted at times, and supply chains and access to raw materials were not intact. In the first half of 2020, budgets were frozen. In the second half of 2020, demand came back, but supply was often disrupted. Many IoT initiatives were halted or, in some cases, canceled in 2020. In 2021, COVID-19 effects have continued to significantly impact some regions, resulting in additional supply chain issues, such as a lack of vessels and shipping containers and port congestion.

The chip shortage: Initially, the chip shortage was a by-product of the COVID-19 impact on the supply chain. However, it has become its own issue; the supply capacity is not available to meet global chip demand. The chip shortage first impacted the automotive industry and then extended to other segments, such as smartphones, televisions, gaming, and IoT. In 2021, the chip shortage is expected to be a factor for up to two more years before enough additional production capacity becomes available. The current shortage is so pervasive that, of 3,000+ analyzed public companies, 11% mentioned “chip shortage” in their conference calls in the second quarter (Q2) of 2021.

These two factors are expected to have a negative impact for several years.

From a connectivity point of view, new technology standards, such as fifth-generation (5G), Wi-Fi 6, and LPWA, are driving device connections. A wildcard in the mix is satellite IoT, which could make a bigger impact toward the latter part of the forecast period.

It is important to note that, while the forecast for the total number of IoT connections has been lowered due to the aforementioned reasons, IoT markets, in general, are accelerating post-COVID-19 (as previously reported). The IoT acceleration is driven by investments into additional software tools and applications and the required integration. Global enterprise IoT spending in 2020 grew 12.1%, reaching $128.9 billion as reported earlier in the year.

Cellular IoT market deep dive: two billion active connections by the end of Q2 2021

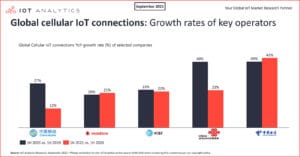

The number of connected IoT devices using cellular technology grew 18% year-over-year (YoY) to reach 2 billion by the end of the first half (1H) of 2021. China Mobile, China Telecom, and China Unicom account for almost three-quarters of the market. In the past 12 months, China Telecom grew 42% and increased its market share by more than two percentage points. Vodafone continues to lead the global market outside of China with a 6% global market share. US-based AT&T grew 22% YoY and held a 4% global market share in 1H 2021. IoT initiatives in China during the last 1.5 years were much less affected by COVID-19 and, in many cases, continued as planned after a short COVID-19 lockdown.

Regarding cellular technologies, the decline of 2G and 3G IoT connections continues, while the mass deployment of 5G connections is anticipated to start this year. Fourth-generation long-term evolution (4G LTE) connections grew 25% YoY due to higher adoption of the long-term evolution category 1 (LTE-Cat 1) and LTE-Cat 1 bis subsegments.

LPWA market deep dive: licensed LPWA market now larger than unlicensed LPWA

In 1H 2020, the share of connected IoT devices using unlicensed LPWA (e.g., long range (LoRa) and Sigfox) led with a 53% share, and licensed LPWA (i.e., narrow-band IoT (NB-IoT) and LTE-machine-type communication (LTE-M)) contributed 47% of global LPWA connections. A year later, licensed LPWA leads with a 54% share, while unlicensed LPWA has a 46% share of global LPWA connections. A key reason is that NB-IoT connections grew 75% YoY in 1H 2021. NB-IoT as a single technology now dominates the LPWA connection market with 44% market share, and LoRa has slipped to second place with a 37% share of global connections.

In the last 12 months, asset tracking and monitoring were the key applications driving unlicensed LPWA growth, while growth in NB-IoT was driven by smart meters and buildings and infrastructure industry verticals.

IoT Analytics expects that NB-IoT and LoRa/LoRaWAN will continue to dominate the market in the coming five years, with LTE-M and Sigfox in distant third and fourth places, respectively. While other technologies will continue to exist, at this point, it does not appear as though they will play a significant role in the overall global market, although they remain attractive for certain niche applications.