Curated by Vinay Prabhakar Minj

- Majority of the investors are interested in startups that are focused on vertical solution.

- Venture capitalists are not keen to invest in startups that provide solutions and services, they usually look for product startups

A large number of IoT startups globally (approx. around 3350 companies) have received a significant amount of funding and a huge amount of capital (around US$ 12.5 billion) has also gone into this space over the past five years.

The investors in this space covers a very wide spectrum and includes traditional venture capitalists, corporate VCs as well as non-traditional investors like utility companies and EMS companies. Crowdfunding is also very active in this space as an alternative for entrepreneurs who are working particularly in the consumer side of things.

Also, there has been a broad trend from industrial to consumer specialisations in various sectors for IoT offerings. Most of the previous efforts in IoT have all been on the consumer side of things where the focus of the companies was to acquire sensor data and put it out into the Cloud for analysis. But with a move towards the industry side, a lot of problems such as connectivity issues, opex issues, battery issues, lifetime issues started to occur with the previous deployments.

“So, over the past five years, companies have bolstered their industrial offerings a lot by shifting their computing to edge. While this has made the gateways a lot more capable of performing analytics, the deployment has now become more on the edge with the training happening on the cloud,” says Rohan Choukkar, investor, Bharat Innovation Fund.

All of this is giving rise to a lot of domain specific and hardcore companies to emerge and thus provide new areas of opportunities.

What investors look for in startups before making investment?

Venture fund Ideaspring Capital, which started in 2016, invests in early stage B2B product innovation startups and provides about half a million funding to each startup. It works with startups in various areas like product management and go-to-market. The company follows a hands-on model under which it tries to bring a startup into the next level in about 18 months, after which it coinvest another 750K. The firm manages to invest in about four-five startups per year.

In the IoT space, the firm is looking to invest in startups that provide a vertical solution to solve the problems faced by a particular sector and those that are working on core technology for IoT.

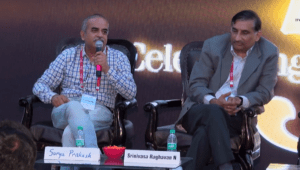

Suryaprakash Konanuru, CTO, Ideaspring Capital, says, “IoT is an area of interest for us, but we haven’t made any direct investments so far. However, our team members such as Flutura and Altizon have made certain investments in this space.”

Meanwhile, StartupXseed is primarily interested in investing in B2B companies with a focus on deep-tech such as silicon IP, robotics, cybersecurity, drone as well as other chip-related technologies. But it is also looking at vertical technology, where everything right from sensing to analytics is addressed in the entire value chain.

“We are interested in companies that offer a complete suite for solving a particular problem,” shares Srinivasa Raghavan N, CTO, StartupXseed.

On the other hand, Venture capital firm IndusAge Partners focuses on Series A investment – it is the stage where the product is already being used by the customers and they are paying for it.

The firm has, so far, made three investments in the IoT space – two in semiconductors (sensor development, autonomous vehicle applications) and one in the vertical space.

“IndusAge Partners has funds of about US$ 200 million and continue to raise the number. It is a fund between the US and India. Investors coming from corporates to high network individuals to financial institutions are raising the funds for investment,” reveals Sundara Nagrajan, MD, IndusAge Advisors (the Advisory arm of IndusAge Partners).

“IoT is not a business or value. Rather, it is a delivery architecture similar to SAS. And just as IT evolved through delivery architecture, so will IoT. Along with sensing and visualisation, actuation (i.e. acting back on the physical world) is another important part that completes the entire IoT chain,” Sundara points out.

Horizontal approach Vs Vertical approach

According to Srinivasa Raghavan, the challenges of being horizontal can be put in three points:-

- Every problem seems to be like an opportunity. And that makes you lose your focus on one particular problem.

- You tend to move towards a solution mode, meaning you become a project organisation moving from one opportunity to another. The problem of the customer cannot be solved by the platform alone. Something else is also required to be built on top of it to solve that problem.

- To achieve scalability, a string of system integration partners and other channel partners needs to be developed who will take your product and offer a solution on top of that. A system integrator will never approach the product of a startup when big companies like Microsoft, Google, Samsung and Intel are investing huge amounts of money to build similar products/platforms.

So, horizontal approach is a viable option for big companies, but not for startups.

In order for a startup to be able to differentiate between a horizontal and vertical space, the key would be to understand the customer challenges and needs. Once you can understand that, then the product/platform can be designed in such a way that the needs can be captured either in the sensor, gateway, middleware or analytics. And this gives you the power to price your products for your customers who can now compare and choose based on its uniqueness.

Though he doesn’t disagree with the above points, Sundara Nagrajan has a slightly different take on the subject as a technical person. According to him, horizontal basically means a module or component in a system. It doesn’t do anything else by itself but is a very important part of the system. Citing an example, he says, while developing a CPU, a decent return is expected by the user within a certain period of time. That return may not always be in terms of money, it can also be in kind as well (based upon a philanthropic activity).

“So, the kind of problem you are solving gets the kind of investment it needs, and scale is all about that. Scalability is all about the economic outcome or the social outcome one is looking for and in order to deliver this outcome, one needs a technological architecture behind it,” he explains.

He stresses that “great scale happens because someone is thinking about it right from the inception of the idea.”

“HORIZONTAL APPROACH IS A VIABLE OPTION FOR BIG COMPANIES, BUT NOT FOR STARTUPS”

From the scale standpoint, an investor, while choosing a startup, always considers whether it has a business plan that can give some confidence about their revenue growth prospect.

“It is not about what you put in the plan, but how did you come up with the plan,” asserts StartupXseed CTO Srinivasa Raghavan.

For example, when building an IoT based healthcare product, the question arises whether it has been validated by several hospitals? Once you have a deep understanding and a certain experience is gained (in terms of class of hospitals, class of patients and segment of interest within those patients), then next is the most important thing which is repeatability (spending a m0nth or longer for solving a patient problem or spending just one minute for the same).

“So, scalability is about time and volume. If you can optimise on the number of devices or units and sell within a short period of time, or implement a SAS or any Cloud application, then you can quickly add up more and more people,” he elaborates.

How startups can attract large enterprises

According to Ideaspring Capital CTO Suryaprakash Konanuru, when approaching big organisations, one needs to keep a couple of things in mind :-

- You should be clear about the value you are adding to them. This requires a detailed study about what they have (or don’t have) and how your solution can fit in. Be patient as this will take time.

- There are two kinds of startups: one which is solving the current problem and the other which is trying to solve a problem which may occur anytime in the future. Solving a current problem will attract more companies as they will prefer to partner with those startups with which they can earn more profit as compared to the future-problem solving startups.

Speaking on this topic from the corporate perspective, Srinivasa Raghavan says there two ways of attracting corporate clients. Corporate as a Customer and Corporate as a Channel to reach the final customer. For the former, he states an example in which some startups are offering their IoT solutions as part the Airbus manufacturing cohort. This doesn’t mean that Airbus will take that startup to their customer, but it is simply using the IoT technology in their manufacturing. So, you might get an opportunity to work with that company, but that company is similar to everyone else.

But, when you are working on a product/solution that is specific to a particular space or companies that are potential channels to the customer, then the likelihood of your idea being picked up the R&D team of that company (upon pitching it to them) will be zero. The reason, according to him, is that they have their own funding and it’s difficult to bring up a partially developed product for the R&D team to work upon.

“LOOK FOR CORPORATES WITH PRODUCT OFFERINGS AND MAKE SURE THAT EACH PRODUCT HAS WELL ESTABLISHED CHANNEL PARTNERS AND SYSTEM INTEGRATION PARTNERS”

In such a scenario, the best method to get an opportunity from a corporate is to look at the products they sell and work with its system integration partners, channel partners, dealers and distributors to fill the gaps in its portfolio. The moment you have a firm foothold, then you can expand your scope in a related area.

If you want to work with corporates, look for corporates with product offerings and make sure that each product has well established channel partners and system integration partners. If you can connect with them and integrate with them, then you would do well.

‘Don’t take funding to build your product’

Try to avoid funding as much as possible. If you can figure out a way to exist without funding, it will be best for the company – suggests Srinivasa Raghavan

“Instead, begin with your personal funding or funding from friends, relatives or angels to build a product and bring it to some stage, have pilots running and workout a business model. After that, go to early stage venture capital funding to scale. Don’t take funding to build your product as it will be time-consuming and stressful with no results to show.”

“Also, don’t dilute your equity too much while giving equity shares to your angel investors. If your non-active partner has 50 percent of equity shares, then venture capitalists will not be interested,” says Srinivasa Raghavan.

“SOLVING A CURRENT PROBLEM WILL ATTRACT MORE COMPANIES AS THEY WILL PREFER TO PARTNER WITH THOSE STARTUPS WITH WHICH THEY CAN EARN MORE PROFIT”

Venture capitalists do not want to invest in solution/service startups

Venture capitalists usually look for product startups and are not keen to invest in startups that provide solutions and services, according to Ideaspring Capital CTO Surya Prakash.

He says that while startups like Mindtree and Happiest Minds managed to receive investments based on their background, it is still rare for other startups. The reason why a product building startup is able to achieve scalability through investments faster is that it is only spending the funding in sales and marketing (this can result in non-linear growth). Whereas a service providing startup has to make human investments to grow and it takes time. But this approach will not give a non-linear growth. This is the reason why venture capitalists are reluctant to invest in service startups.

Do not depend on friends/relatives for funding, it can ruin relationships!

Contrary to the other two experts, Sundara Nagrajan, MD of IndusAge Advisors, opines that while fundraising should be a part of one’s startup strategy, one should not depend on friends and relatives at all for funding. Because, he says, the probability of a startup succeeding (which means economically giving returns to the investors) is less than 5 percent and failure to get return on investment can ruin relationships.

So, when you are getting a venture capital firm to invest, you should also have a plan for the returns.

Tips From the Experts

Each and every entrepreneur should deeply think about the problems that they are solving and understand in depth about the economic value in this. When you figure out the economic value or social value, then only an enterprise can exist – Sundara Nagrajan.

Broadly any business needs to have three components – what is the core technology platform; what is your business model; and how will you create customer experience. If you can bring a harmony between three components in a meaning way, you are more likely to succeed in the business – Srinivasa Raghavan.

One should focus on creating great technology, but at the same time one should also look at the type of problem you are solving and try to get customer validation at an early stage. Once you get customer validation, investors will come follow you on their own – Suryaprakash Konanuru.